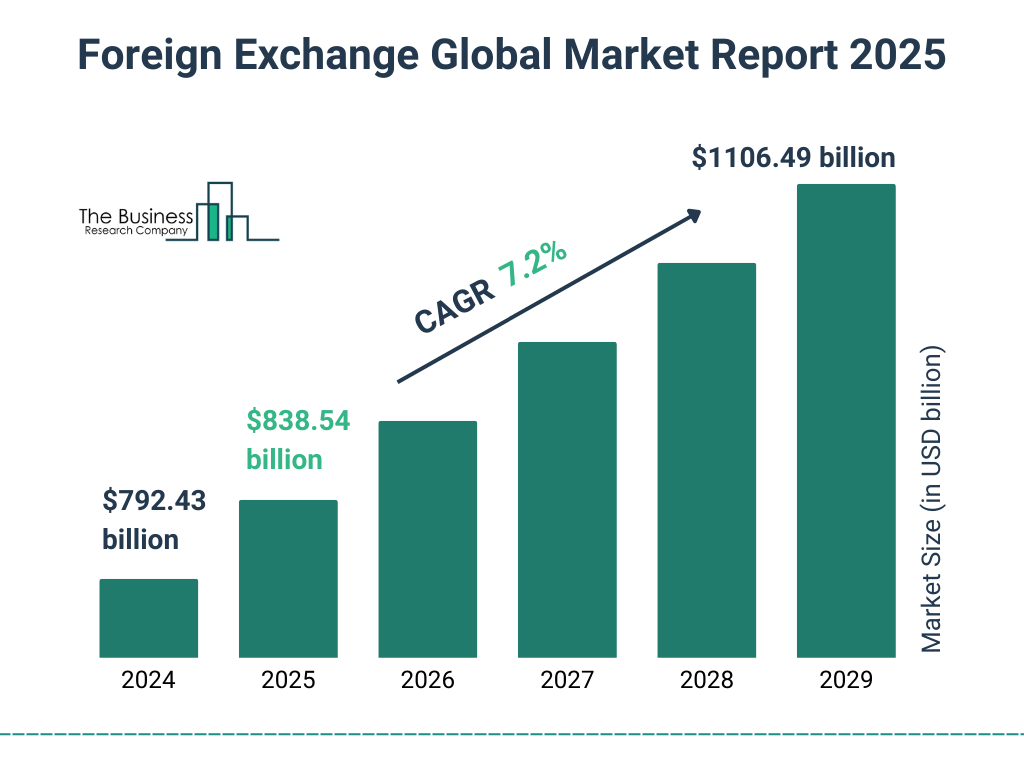

Forex trading, the art of exchanging one currency for another to profit from market fluctuations, is both an exciting and challenging endeavor. With a daily trading volume exceeding $7.5 trillion, the forex market is the largest and most liquid financial market globally, offering immense opportunities for traders. However, success in forex trading hinges on employing effective strategies that align with your goals, risk tolerance, and trading style. This comprehensive guide explores the most popular and profitable forex trading strategies, providing actionable insights for beginners and seasoned traders alike.

What Are Forex Trading Strategies?

A forex trading strategy is a systematic approach to deciding when to buy or sell a currency pair. These strategies rely on technical analysis (charts, indicators), fundamental analysis (economic data, news), or a blend of both to identify trading opportunities. The key to profitability lies in consistency, discipline, and adapting to ever-changing market conditions.

Popular Forex Trading Strategies

- Trend Following

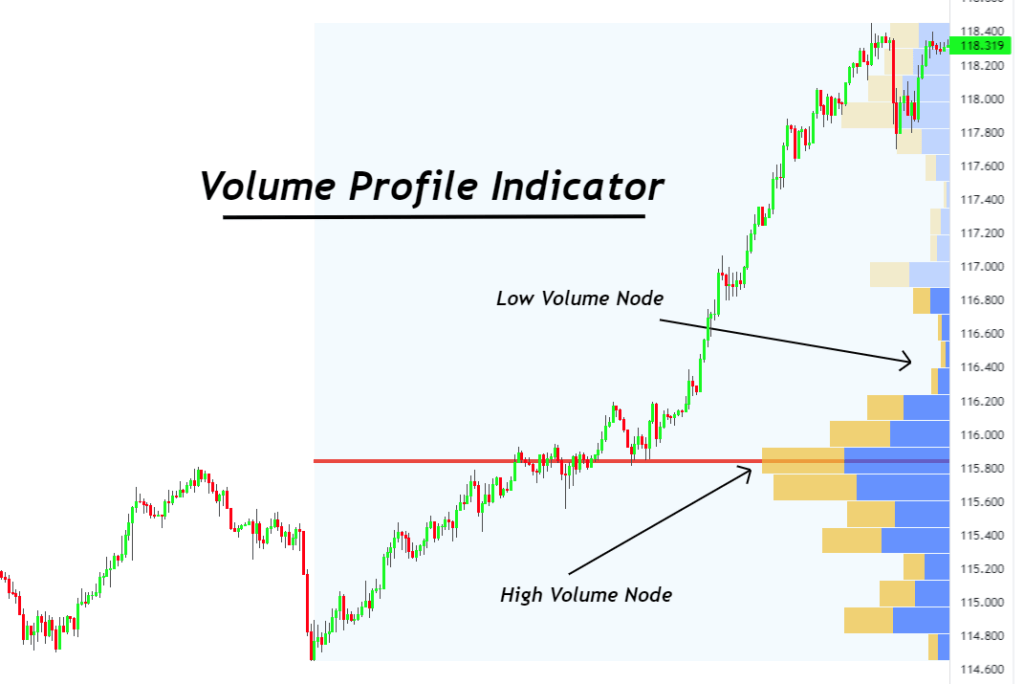

- Overview: This strategy involves identifying and trading in the direction of the prevailing market trend—upward (bullish), downward (bearish), or sideways.

- How It Works: Traders use tools like moving averages (e.g., 50-day or 200-day EMA) or the Average Directional Index (ADX) to confirm trends. For example, a buy signal occurs when a short-term moving average crosses above a long-term moving average.

- Best For: Traders who prefer riding long-term price movements and have patience to wait for confirmation.

- Pros: Simple to implement, works well in strong trending markets.

- Cons: Less effective in choppy, range-bound markets.

- Scalping

- Overview: Scalping is a fast-paced strategy where traders aim to profit from small price movements, often holding positions for mere minutes.

- How It Works: Scalpers use low time-frame charts (e.g., 1-minute or 5-minute) and indicators like Bollinger Bands or the Relative Strength Index (RSI) to spot quick entry and exit points. A common tactic is to "beat the bid/offer spread" and secure a few pips per trade.

- Best For: Active traders with time to monitor markets closely and a high risk tolerance.

- Pros: High trade frequency, potential for quick profits.

- Cons: Requires intense focus, high transaction costs can erode gains.

- Day Trading

- Overview: Day traders open and close positions within a single trading day, avoiding overnight risks.

- How It Works: Using 60-minute or 4-hour charts, traders analyze intraday price action with tools like candlestick patterns or the Stochastic Oscillator. For instance, a trader might buy EUR/USD after a bullish engulfing pattern forms near a support level.

- Best For: Traders who can dedicate a few hours daily and prefer short-term opportunities.

- Pros: Eliminates overnight risk, leverages intraday volatility.

- Cons: Demands quick decision-making and can be stressful.

- Swing Trading

- Overview: Swing trading targets medium-term price swings, with positions held for days or weeks.

- How It Works: Traders use 4-hour or daily charts to identify "swing highs" and "swing lows." Fibonacci retracement levels or moving average crossovers often guide entries and exits.

- Best For: Traders with patience and a balanced risk-reward approach.

- Pros: Less time-intensive, capitalizes on larger price moves.

- Cons: Exposed to overnight gaps and unexpected news events.

- Position Trading

- Overview: A long-term strategy focused on capturing major market trends over weeks, months, or even years.

- How It Works: Position traders rely heavily on fundamental analysis (e.g., interest rates, GDP growth) alongside weekly or monthly charts. A trader might buy AUD/USD anticipating a strengthening Australian economy.

- Best For: Patient traders with a macro-economic perspective.

- Pros: Requires minimal daily monitoring, potential for significant gains.

- Cons: Slow to realize profits, vulnerable to long-term market shifts.

- Breakout Trading

- Overview: This strategy involves entering a trade when the price breaks through a key support or resistance level.

- How It Works: Traders watch for consolidation zones (e.g., triangles, channels) on charts and place buy/sell orders just beyond these levels. For example, a breakout above resistance on USD/JPY might signal a bullish move.

- Best For: Traders who thrive on volatility and momentum.

- Pros: High reward potential during strong moves.

- Cons: False breakouts can lead to losses.

- Carry Trade

- Overview: A strategy that profits from interest rate differentials between two currencies.

- How It Works: Traders buy a currency with a high interest rate (e.g., AUD) and sell one with a low rate (e.g., JPY), earning the differential overnight. For instance, holding AUD/JPY long-term could yield interest alongside price gains.

- Best For: Long-term traders in stable market conditions.

- Pros: Passive income from interest, leverages economic fundamentals.

- Cons: Sensitive to sudden rate changes or market volatility.

Key Tips for Success

- Risk Management: Never risk more than 1-2% of your capital per trade. Use stop-loss orders to limit losses.

- Backtesting: Test your strategy on historical data or a demo account to assess its effectiveness.

- Emotional Discipline: Avoid impulsive decisions driven by fear or greed—stick to your plan.

- Adaptability: Markets evolve, so refine your strategy as conditions change.

- Economic Awareness: Stay informed about news releases (e.g., U.S. Non-Farm Payrolls) that can impact currency pairs.

Choosing the Right Strategy

The best strategy depends on your personality, time availability, and risk appetite. Scalping suits fast-paced traders, while position trading fits those with a long-term view. Beginners might start with trend following or day trading for simplicity, while advanced traders could explore combinations like trend following with breakout confirmation.

Forex trading is inherently risky, and no strategy guarantees success. However, with practice, analysis, and a disciplined approach, you can tilt the odds in your favor. Start small, learn continuously, and let your strategy evolve with your experience.