Forex trading isn’t just about luck—it’s about precision, timing, and mastering advanced strategies that tilt the odds in your favor. In 2025, as markets grapple with inflation pressures, shifting monetary policies, and technological disruptions, seasoned traders need an edge beyond the basics. This post explores advanced forex trading strategies that combine sophisticated analysis, market psychology, and cutting-edge tools to unlock high-probability trades. Whether you’re aiming to refine your skills or dominate the charts, these techniques will elevate your game.

What Makes a Strategy “Advanced”?

Advanced strategies go beyond simple moving averages or support levels. They integrate multiple layers of analysis—technical, fundamental, and sentiment—while leveraging market inefficiencies. These approaches demand experience, patience, and a willingness to adapt, but they reward traders with sharper entries, bigger wins, and tighter risk control.

Advanced Forex Trading Strategies

- Fibonacci Confluence Trading

- Overview: A precision strategy that stacks Fibonacci retracement levels with other key zones for high-probability setups.

- How It Works: On a daily chart, draw Fibonacci retracement levels from a major swing high to low (e.g., on USD/JPY). Look for confluence where a Fib level (like 61.8%) aligns with support/resistance, a trendline, or a 200 EMA. Enter with a candlestick confirmation (e.g., pin bar), risking 20 pips to target 60-80 pips.

- Best For: Technical traders who love layered analysis.

- Pros: Pinpoints high-reward zones, filters weak signals.

- Cons: Requires practice to spot confluence accurately.

- Order Block Trading

- Overview: A supply-and-demand strategy that targets institutional “order blocks” where big players enter or exit.

- How It Works: On a 4-hour chart, identify a tight consolidation zone before a strong breakout (e.g., on EUR/GBP). This “block” often marks where banks or funds placed orders. Wait for price to return to this zone, then trade the bounce or breakout with a stop beyond the block. Risk 1% for a 3:1 reward ratio.

- Best For: Traders who study market structure.

- Pros: Taps institutional moves, high accuracy.

- Cons: Needs deep chart-reading skills, fewer setups.

- Harmonic Pattern Trading

- Overview: A geometric strategy using patterns like Gartley, Bat, or Crab to predict reversals with uncanny precision.

- How It Works: Use a harmonic pattern tool (e.g., on TradingView) to spot formations on a 1-hour or 4-hour chart. For a Bullish Gartley on GBP/USD, enter at the D-point (e.g., 78.6% Fib retracement) with a stop below X and a target at 38.2%-61.8% of the A-D move. Combine with RSI divergence for confirmation.

- Best For: Analytical traders who enjoy patterns.

- Pros: Defined risk/reward, visually striking setups.

- Cons: Complex to learn, false patterns occur.

- Correlation Arbitrage

- Overview: An advanced tactic that exploits temporary mispricings between correlated assets.

- How It Works: Monitor pairs like Gold (XAU/USD) and USD Index (DXY), which often move inversely. If XAU/USD spikes but DXY lags (breaking correlation), short XAU/USD and long a USD pair like USD/CAD, expecting reversion. Use small positions (e.g., 0.05 lots) and exit when alignment restores.

- Best For: Multi-market traders with fast execution.

- Pros: Low-risk arbitrage, capitalizes on inefficiencies.

- Cons: Rare opportunities, requires real-time data.

- Smart Money Reversal

- Overview: A strategy that tracks “smart money” (banks, hedge funds) to catch reversals after retail traders get trapped.

- How It Works: On a 1-hour chart, spot a liquidity grab—e.g., price sweeps below a key low on AUD/USD, triggering stop-losses, then reverses sharply. Enter long at the reversal with a stop below the sweep, targeting the next resistance. Risk 15 pips for 45-60 pips.

- Best For: Contrarian traders who read manipulation.

- Pros: High reward on traps, aligns with big players.

- Cons: Timing is tricky, needs experience.

Tools to Supercharge Advanced Trading

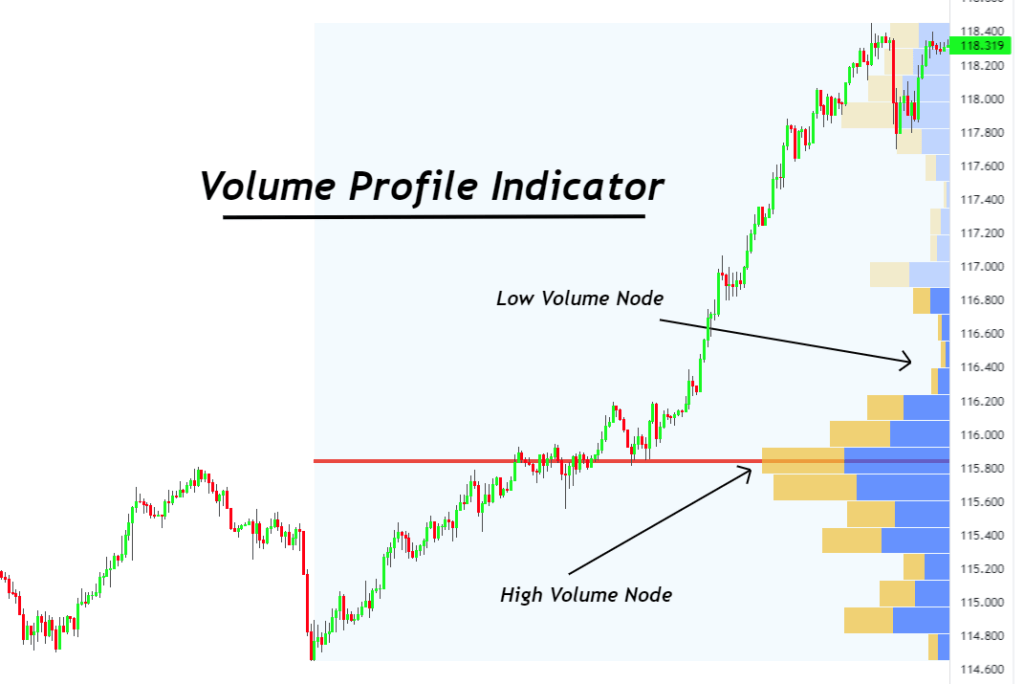

- Volume Profile: Reveals hidden support/resistance based on traded volume, enhancing order block setups.

- COT Report: The Commitment of Traders data shows hedge fund positions—pair it with harmonics for macro confirmation.

- Algo Alerts: Use custom indicators or bots to flag Fibonacci confluence or harmonic patterns in real time.

- Sentiment Analysis: Check X posts or forex forums for retail bias—trade against the crowd in smart money setups.

Thriving in 2025’s Market

This year’s forex landscape—marked by potential rate cuts, crypto crossovers, and emerging market volatility—favors traders who think three steps ahead. Advanced strategies like these thrive on complexity, turning chaotic price action into calculated wins. Start with one, backtest relentlessly, and blend it with your style. The market rewards those who dare to dig deeper.